Founder, Marketer, Solopreneur.

Email Marketing For Insurance Agents

Leveraging AWeber Email Marketing for More Insuarance Policy Sales

As an Insurance Agent, you’re always on the lookout for innovative ways to gain prospects, confirm renewals and close more deals. Today, we’ll take a close look at one powerful strategy that can transform your insurance broking business: email marketing. More specifically, we’ll explore how you can use AWeber’s email marketing platform to reach your goals.

Why AWeber for Insurance Agents?

AWeber is a robust email marketing platform that allows you to create and send customized emails to your prospects and clients. But why should agents specifically consider AWeber? Here are a few key reasons:

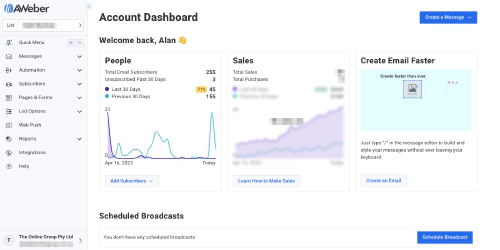

- Automation: AWeber lets you automate your emails, which means you can set up drip campaigns that nurture leads over time, sending new policy options, industry news, referral requests and automated upsell offers without any manual effort on your part.

- Segmentation: You can categorize your subscribers into different groups based on their preferences, whether they’re looking for home insurance, business insurance, life insurance, income protection, their location, and more. This ensures that your subscribers receive relevant information, increasing the chances of conversion.

- Tracking and analytics: Understand your clients’ behavior better with AWeber’s analytics. Monitor which emails are opened, which links are clicked, and use this data to refine your approach and make more sales.

How to Use AWeber to Get More Policy and Renewal Business

Now that we understand why AWeber is a strong choice for the Insurance industry, let’s take a look at how you can use it to boost your business.

1. Lead Generation for Insurance Agents

AWeber allows you to design attractive sign-up forms that you can embed on your website. Use these forms to collect contact information from people visiting your website, whether they’re looking at product options or just reading your blog. You can add different sign ups to different pages and use these to track which external marketing afforts are resutling in new insurance leads.

2. Drip Campaigns

Once you’ve captured those leads, it’s time to nurture them. Create a series of automated emails that educate potential clients about the insurance process, share testimonials from satisfied clients, provide market insights, and showcase your knowledge on the ins and outs of the insurance game.

3. Regular Newsletters

Stay on top of mind with your clients by sending out regular newsletters. Share useful content such as tips on what to look out for and what to avoid, how to make sure claims are paid out, local events, and your recent successes in helping clients protect their family and assets. This helps build a strong relationship over time that ultimately leads to more business and referrals.

4. New Product Options

Use AWeber to send personalized details on new and better insurance products as they are released. Remember, you can segment your audience based on their preferences such as location, property type and price range, ensuring you’re placing the opportunity to write new business in front of people who already know you.

5. Ask for Referrals

While you keep your prospects informed about the latest insurance industry news, ask them to refer you to their contacts whenever they get the chance. You might like to incentivize this if that is permitted in your state.

6. Success Stories and Testimonials

Sharing success stories and testimonials in your emails will build trust and show prospects that you’re the best insurance agent for their needs.

7. Follow-Ups

Once you quote on a new policy, use AWeber to send follow-up emails. These can thank prospects for their time, provide additional information about the proposal, or ask for feedback.

With AWeber’s powerful email marketing features , you’re well-equipped to bring your insurance agency to the next level. By consistently reaching out to prospects with relevant, engaging content, you’ll be sure to increase your close rate.

AWeber: More than Just Email Marketing

While AWeber is primarily an email marketing platform, it also offers features that extend beyond just email, which can further help you build your insurance business.

1. Landing Pages

AWeber allows you to build customized landing pages. This can be especially helpful if you’re promoting a specific policy offer or running a particular campaign. For instance, if you have a new luxury vehicle insurance offer, you could create a landing page dedicated to it, filled with beautiful photos, key features, and a signup form for interested potential buyers.

2. Web Push Notifications

Web push notifications are another way to keep potential buyers updated. Users who opt in will get a notification on their device whenever you publish a new offer or other important update.

3. Integrations

AWeber integrates seamlessly with over 700 other tools you might be using, like customer relationship management (CRM) systems, social media platforms, or websites. This allows you to coordinate your efforts and ensure that you’re reaching your audience on multiple fronts.

Conclusion

Whether you’re a seasoned insurance agent or just starting in the industry, it’s clear that leveraging a tool like AWeber can make a significant difference. By automating, personalizing, and optimizing your communications with potential buyers, you’ll be able to secure more insurance quotes and close more sales — all while providing a better service to your clients.

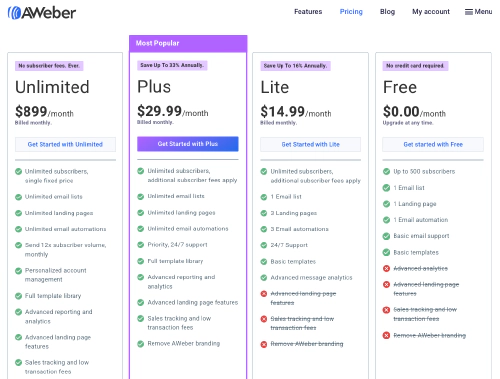

AWeber offers a range of packages suitable for different budgets and business sizes.

You can start your list, send emails and build a list of 500 contacts for free.

So why wait? Start harnessing the power of email marketing for your insurance business today and watch your success grow.

Let’s look at email marketing in a little more detail.

Email marketing has long been considered a cornerstone of digital marketing strategies, offering a direct line of communication between businesses and their customers. A well-crafted email campaign can:

- Strengthen customer relationships

- Increase brand awareness

- Drive sales and conversions

Email marketing for an insurance agency business is a vital tool in your marketing arsenal, allowing you to reach your target audience in a personal, cost-effective manner.

Building a Bountiful Subscriber Base

Before diving into the world of email marketing campaigns, it’s essential to first establish a solid foundation. Building a decent subscriber base is a critical step in ensuring the success of your campaigns. Here are some tried-and-true tactics to help you grow your email list:

- Offer exclusive promotions for subscribers

- Offer to confirm appointments via email

- Encourage social media followers to subscribe

- Add a signup form to your website

Crafting Compelling Campaigns

Once you’ve established a strong subscriber base, it’s time to start crafting compelling campaigns. Here are some key elements to consider when creating your email marketing content:

- Subject Line: An eye-catching, creative subject line is the gateway to your email, enticing recipients to open and read further.

- Personalization: Addressing your subscribers by name, or tailoring content based on their preferences, adds a personal touch that can lead to higher engagement rates.

- Visual Appeal: Including images, videos, and a clean design can make your emails more visually appealing and easier to digest.

- Call-to-Action (CTA): A clear, concise CTA is essential for guiding your subscribers to take the desired action, whether that’s making a booking, leaving a review, or attending a webinar or seminar.

Analyzing and Adapting

As with any marketing strategy, it’s essential to track the performance of your email campaigns to determine their effectiveness. Key metrics to consider include:

- Open rates

- Click-through rates

- Conversion rates

- Unsubscribe rates

By analyzing these metrics, you can identify trends, strengths, and areas for improvement. This information will enable you to adapt and optimize your email marketing efforts for even greater success.

FAQs:

Q: How often should I send emails to my subscribers?

A: The ideal frequency for sending emails will vary depending on your business and audience. It’s crucial to strike a balance between staying top-of-mind and not overwhelming your subscribers with too many messages. Generally, sending 1-2 emails per week is a safe bet for most insurance agents.

Q: What is the best time to send marketing emails?

A: The optimal time to send marketing emails can differ based on your audience and industry. It’s a good idea to test different days and times to determine when your subscribers are most likely to engage with your content. With Aweber you can see how many emails get opened. You can experiment with different days and times of day to see which works best.

Q: Is email marketing still effective in today’s digital age?

A: While there are many marketing channels available, email marketing remains a highly effective method for reaching and engaging with your target audience. In fact, studies have shown that email marketing can yield an impressive return on investment (ROI), making it an indispensable tool for small businesses in today’s digital age.

Q: How do I ensure my emails don’t end up in the spam folder?

A: To avoid the dreaded spam folder, make sure you’re following best practices for email deliverability. Some tips include:

- Using a reputable email service provider (ESP) like Aweber

- Sending emails only to subscribers who have opted in (don’t buy a list)

- Avoiding spam-triggering words and phrases in your subject lines and content

- Regularly cleaning your email list to remove inactive subscribers

Conclusion

Email marketing for the insurance industry is a powerful and cost-effective way to build customer relationships, increase brand awareness, and ultimately drive success in today’s competitive insurance landscape. By focusing on building a robust subscriber base, crafting compelling campaigns, and continually analyzing and adapting your strategies, you can harness the power of email marketing to elevate your entrepreneurial endeavors. So, whether you’re a seasoned pro or just starting your insurance journey, don’t overlook the immense potential of email marketing. With a little creativity and dedication, you’ll soon see the fruits of your labor, propelling your insurance career to new heights.

Don’t Have the Time or Skills to Set Things Up

If you have a skills gap when it comes to implementing technology like Aweber I am always happy to talk. Just use the book a call button at the top of this page and we can discuss your requirements and any services I may be able to provide in the areas of set up, content and ongoing operations.

You can check it out here: